Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Will homeowner insurance cover damage from frozen pipes?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts.

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

How urgent is a burst pipe?

Put an end to the leaky pipes as soon as possible!

Even over brief periods of time, undetected burst pipes can result in significant property damage and higher water costs. Known as “water damage,” this problem can lead to flooding, damage walls and furniture, and ruin existing flooring.

Will homeowner insurance cover damage from frozen pipes?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts.

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Here are several steps you can take if your pipes freeze during a winter storm this 2024:

- Activate the faucet and leave it running. In the future, a burst pipe can be avoided by letting the faucet drip, even a little bit.

- Use a hair dryer to gently apply heat to the frozen spot. Air should be directed toward the faucet end of the pipe and progressively moved toward the coldest part. Take caution not to blow a fuse or overheat the hair dryer. Avoid using a propane torch since it might cause damage to the pipe and increase the risk of a fire.

- Don’t stop heating until the water pressure is fully restored. Keep applying heat. Even so, after the pipe has thawed, it’s a good idea to leave the faucet open for a few minutes. This will allow the ice to get far enough away from the line.

- Examine every faucet in your house to look for any further frozen pipes and prevent pipes from freezing in the future. It’s possible that other pipes have been impacted by one frozen pipe.

The pipes will probably take half an hour to thaw. This might change, though, based on the temperature, the length of time the pipe has been frozen, and its location. If none of the aforementioned actions work for you, you should contact a plumber for help.

How urgent is a burst pipe?

Put an end to the leaky pipes as soon as possible!

Even over brief periods of time, undetected burst pipes can result in significant property damage and higher water costs. Known as “water damage,” this problem can lead to flooding, damage walls and furniture, and ruin existing flooring.

Will homeowner insurance cover damage from frozen pipes?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts.

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

What to do if your pipes freeze during a winter storm: 2024 Update

Even interior pipes can freeze in subzero conditions.

The likelihood of your pipes freezing and rupturing increases dramatically when the weather drops. According to the Insurance Institute for Business and Home Safety, burst pipes are one of the most frequent reasons for property loss during extremely cold weather. They can quickly result in thousands of dollars worth of water damage, or even more. If you experience frozen pipes at your home or business after a winter storm, continue reading this article.

Here are several steps you can take if your pipes freeze during a winter storm this 2024:

- Activate the faucet and leave it running. In the future, a burst pipe can be avoided by letting the faucet drip, even a little bit.

- Use a hair dryer to gently apply heat to the frozen spot. Air should be directed toward the faucet end of the pipe and progressively moved toward the coldest part. Take caution not to blow a fuse or overheat the hair dryer. Avoid using a propane torch since it might cause damage to the pipe and increase the risk of a fire.

- Don’t stop heating until the water pressure is fully restored. Keep applying heat. Even so, after the pipe has thawed, it’s a good idea to leave the faucet open for a few minutes. This will allow the ice to get far enough away from the line.

- Examine every faucet in your house to look for any further frozen pipes and prevent pipes from freezing in the future. It’s possible that other pipes have been impacted by one frozen pipe.

The pipes will probably take half an hour to thaw. This might change, though, based on the temperature, the length of time the pipe has been frozen, and its location. If none of the aforementioned actions work for you, you should contact a plumber for help.

How urgent is a burst pipe?

Put an end to the leaky pipes as soon as possible!

Even over brief periods of time, undetected burst pipes can result in significant property damage and higher water costs. Known as “water damage,” this problem can lead to flooding, damage walls and furniture, and ruin existing flooring.

Will homeowner insurance cover damage from frozen pipes?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts.

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

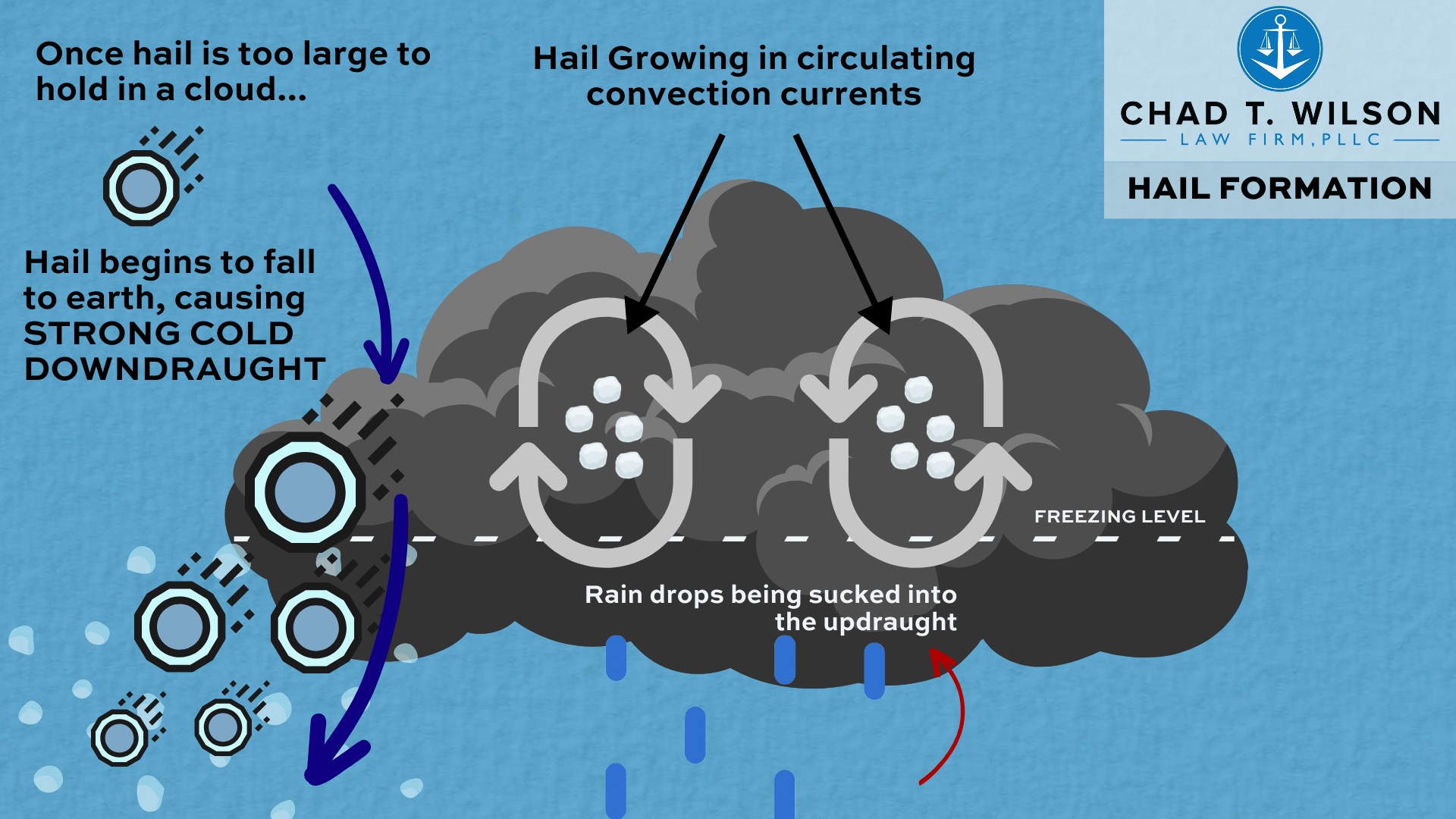

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Chad T. Wilson – Resources

January 15, 2024

Updated: January 15, 2024 09:20 a.m.

Source: https://cwilsonlaw.com

What to do if your pipes freeze during a winter storm: 2024 Update

Even interior pipes can freeze in subzero conditions.

The likelihood of your pipes freezing and rupturing increases dramatically when the weather drops. According to the Insurance Institute for Business and Home Safety, burst pipes are one of the most frequent reasons for property loss during extremely cold weather. They can quickly result in thousands of dollars worth of water damage, or even more. If you experience frozen pipes at your home or business after a winter storm, continue reading this article.

Here are several steps you can take if your pipes freeze during a winter storm this 2024:

- Activate the faucet and leave it running. In the future, a burst pipe can be avoided by letting the faucet drip, even a little bit.

- Use a hair dryer to gently apply heat to the frozen spot. Air should be directed toward the faucet end of the pipe and progressively moved toward the coldest part. Take caution not to blow a fuse or overheat the hair dryer. Avoid using a propane torch since it might cause damage to the pipe and increase the risk of a fire.

- Don’t stop heating until the water pressure is fully restored. Keep applying heat. Even so, after the pipe has thawed, it’s a good idea to leave the faucet open for a few minutes. This will allow the ice to get far enough away from the line.

- Examine every faucet in your house to look for any further frozen pipes and prevent pipes from freezing in the future. It’s possible that other pipes have been impacted by one frozen pipe.

The pipes will probably take half an hour to thaw. This might change, though, based on the temperature, the length of time the pipe has been frozen, and its location. If none of the aforementioned actions work for you, you should contact a plumber for help.

How urgent is a burst pipe?

Put an end to the leaky pipes as soon as possible!

Even over brief periods of time, undetected burst pipes can result in significant property damage and higher water costs. Known as “water damage,” this problem can lead to flooding, damage walls and furniture, and ruin existing flooring.

Will homeowner insurance cover damage from frozen pipes?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts.

What to do if your insurance claim is denied or underpaid after a pipe burst causes water damage?

You might be able to file a lawsuit against your insurance provider if a burst pipe caused damage to your property and they either rejected your claim or paid you significantly less than the true cost of the damage. A pipe damage attorney can assist you in determining what to do next. Allow The Chad T. Wilson Law Firm insurance lawyers in Houston to defend your rights to justice and recompense. For a free consultation, reach out to us today. If your lawsuit is unsuccessful, there will be no payment due.

How can you Prevent Your Pipes From Freezing During a Winter Storm in the future?

The pipes in unheated interior spaces, such as garages, attics, and basements, are the most vulnerable. However, pipes that pass through external walls or cupboards may also freeze. The good news is that you can maintain dry conditions in your home and running water by taking a few easy steps.

The American Red Cross, which deals with emergency preparedness, and the IBHS both offer helpful tips on how to keep your pipes from freezing and how to thaw them if they do.

Why Pipe Freezing is Such a Serious Problem:

One peculiar characteristic of water is that it expands when it freezes. Anything holding it in place, such as metal or plastic pipes, is under extreme pressure from this expansion. Expanding water has the potential to shatter pipes, regardless of how sturdy the container is.

The most commonly freezing pipes are:

- Pipes that are subjected to extreme cold, such as sprinkler lines, swimming pool supply lines, and outdoor hose bibs.

- Water supply pipes in unheated interior places such basements and crawl spaces, attics, garages, or kitchen cabinets.

- Pipes that run against exterior walls that have minimal or no insulation.

Here are some tips to help avoid frozen pipelines in the future:

- In frigid weather, set your home’s thermostat above 55 degrees.

- Pour cold water into the faucet that is furthest away from your main valve. Water in motion prevents pipes from freezing.

- Find emergency shut-off valves.

- In locations without heat, insulate pipes.

- To warm the pipes, open the cabinets and vanities.

- Shut off the internal water supply valves.

- Open the outside spigots to allow to drain water out.

- Keep the outside valve open to allow any leftover water in the pipe to expand without rupturing.

- Turn off the water at outside spigots and remove all water from the line when freezing weather is predicted.

Water utilities are responsible for water mains and pipe lines that connect to your home, but not pipes located on your property. If a pipe bursts on your property, call a plumber immediately for repairs. Help protect your pipes from potential damage and avoid costly repairs by following these steps.

Is your claim being denied? Call The Chad T. Wilson Law Firm, PLLC.

Speak with one of our attorney if you’re having trouble getting your claim processed or if the insurance company is attempting to pay less for the claim than is reasonable.

Contact us: https://cwilsonlaw.com/contact-us/

Learn more about our attorneys:

https://cwilsonlaw.com/meet-the-team-chad-t-wilson-law-firm-pllc-insurance-attorney/

Follow us on Social media:

https://beacons.ai/chadtwilsonlaw

Contact our Chad T. Wilson Law Firm Office Locations to Schedule a free Consultation.

Chad T. Wilson is an attorney whose firm specializes in property insurance disputes.

Written By:

Alejandro Caro

Recent Comments