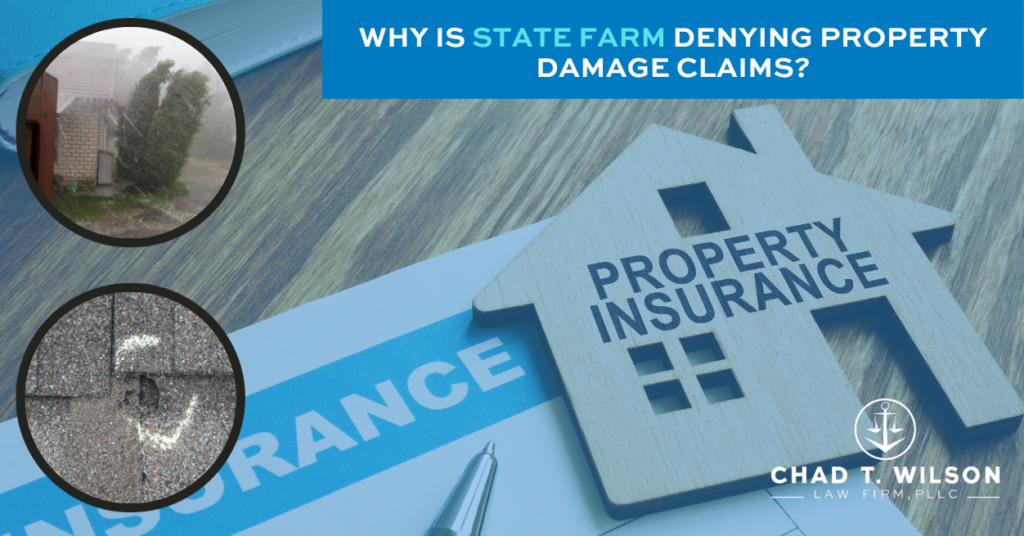

Why Is State Farm Denying Property Damage Claims?

Understanding State Farm Property Damage Denials

Many homeowners are surprised when State Farm denies property damage claims. In 2025, this trend is not just a coincidence. Homeowners nationwide, particularly in Oklahoma, Texas, and Colorado, are sharing similar stories after experiencing storms, wildfires, and other damaging events. Knowing the most common reasons can help you avoid claim rejection and ensure you receive fair coverage for your property damage claim.

Recent State Farm Concerns and Legal Issues

State Farm has faced numerous concerns regarding its handling of insurance claims over the years. For example:

-

Since the 2020 Colorado wildfires, many customers have reported issues with denied or delayed claims.

-

In 2022, State Farm paid a $100 million settlement to the federal government over improperly managed flood insurance claims during Hurricane Katrina.

Common Reasons State Farm Denies Claims

1. Cosmetic Damage or Preexisting Issues

State Farm often labels certain damage as “cosmetic” or preexisting, meaning they claim it existed before your policy coverage started.

-

Dents, scratches, or minor wear are frequently categorized this way.

-

To avoid disputes, document your property condition before and after storms.

2. Inaccurate or Low Damage Assessment

Adjusters may report less damage than contractors or underestimate repair costs.

-

This can result in partial payouts or outright claim denial.

-

Independent inspections can provide evidence to support your full claim.

3. Policy Exclusions

Every homeowner’s insurance policy has specific exclusions. Common examples:

-

Certain roof materials not covered

-

Water damage due to maintenance issues

-

Damage from wear and tear

Understanding your policy can prevent unexpected denials.

4. Filing or Documentation Errors

Claims can be denied if forms are incomplete or deadlines are missed.

-

Always keep photos, repair estimates, and receipts ready

-

Ensure all required documents are submitted in a timely manner

If your claim is turned down, you have the following options:

Obtain the Denial Letter, then carefully read it.

The denial letter should include the insurance company’s perspective on the matter and a detailed explanation of the reasons your claim was rejected. You should carefully read and consider this letter in order to comprehend the reasons for the denial of your claim, as well as your future course of action.

Assemble evidence:

Before taking any further action, find out why the claim was denied and collect any more supporting documentation. This may consist of videos, pictures, witnesses, and more.

Appeal the final decision:

Make sure you adhere to State Farm’s prescribed processes if you choose to contest the denial. Any errors could end up costing you more time and effort and increasing the risk associated with your claim. To assist you with the procedure, you might also want to think about working with a property damage lawyer.

Don’t give up hope just yet if State Farm rejected your claim!

There might still be options to pursue in order to recover damages related to the occurrence, depending on the insurer’s justifications for rejecting your claim and your specific situation.

If you believe your claim has been rejected without cause or that your adjuster did not sufficiently examine the claim, you may consider calling The Chad T. Wilson Law Firm for help with your insurance claim.

Frequently Asked Questions:

Can State Farm deny my claim for cosmetic damage?

Yes, if the damage existed before your policy or is considered minor.

How long do I have to appeal a denied claim?

Deadlines vary by state and policy. Contact a property damage lawyer immediately to protect your rights.

Should I hire a lawyer for a denied or underpaid claim?

If the claim is significant or State Farm disputes your evidence, a property damage lawyer can help you get the settlement you deserve.